The Top Myths and Misunderstandings Regarding Offshore Investment Debunked

The Top Myths and Misunderstandings Regarding Offshore Investment Debunked

Blog Article

Comprehending the Kinds Of Offshore Investment and Their One-of-a-kind Attributes

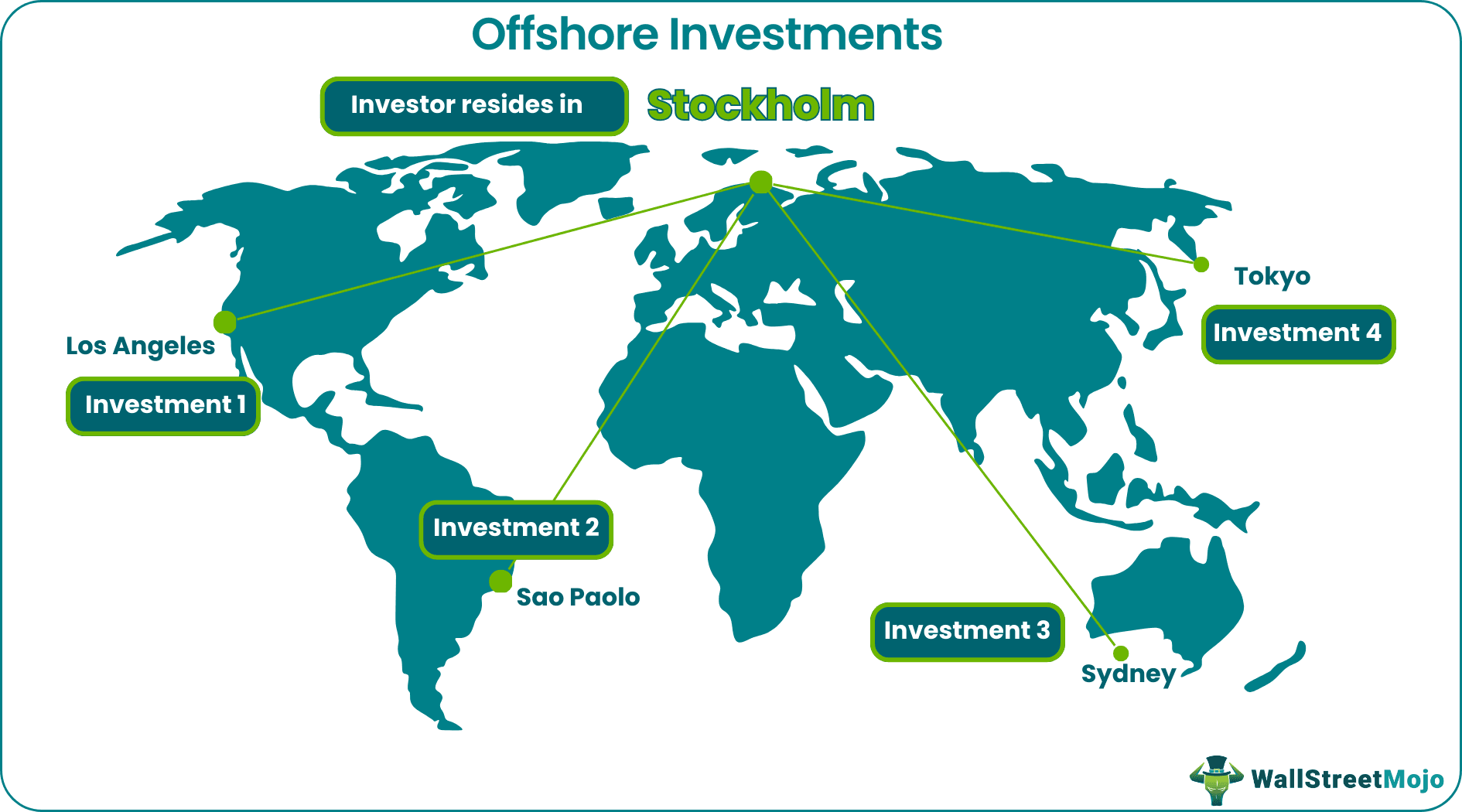

In a progressively globalized economy, recognizing the various kinds of offshore financial investments is essential for effective riches management and possession defense. Each financial investment automobile, from overseas bank accounts to shared funds and counts on, offers unique attributes customized to satisfy varied economic goals.

Offshore Bank Accounts

Offshore bank accounts work as a strategic monetary tool for services and individuals seeking to diversify their possessions and manage money risk. These accounts are commonly developed in territories that supply beneficial financial laws, personal privacy protections, and a secure political and financial atmosphere. By holding funds in varied money, account owners can properly alleviate the dangers connected with currency changes, making certain better economic stability.

However, it is vital to conform with all relevant tax obligation legislations and regulations when using offshore banking services. Failing to do so might cause lawful effects and economic fines. For that reason, possible account owners should seek expert recommendations to navigate the intricacies of overseas financial and guarantee they are fully certified while gaining the advantages of asset diversity and threat management.

Offshore Mutual Finances

Investing in mutual funds can be an efficient approach for individuals seeking to gain access to international markets while benefiting from professional administration and diversification. Offshore shared funds function as an engaging alternative for investors wanting to profit from chances past their residential markets. These funds pool capital from numerous financiers to purchase a diversified portfolio of possessions, which might include equities, bonds, and alternate investments.

One of the primary advantages of offshore mutual funds is the potential for enhanced returns with accessibility to global markets that may not be available domestically. These funds usually give tax advantages depending on the jurisdiction, allowing capitalists to maximize their tax responsibilities. Additionally, expert fund managers proactively manage these investments, making informed decisions based upon rigorous study and market analysis.

Financiers in offshore shared funds benefit from the versatility to select different fund strategies, ranging from conservative to aggressive financial investment methods. This variety enables people to straighten their investment selections with their danger resistance and financial goals. However, it is essential for financiers to conduct comprehensive due persistance and comprehend the governing atmosphere, costs, and dangers related to these financial investment vehicles before dedicating resources.

Offshore Counts On

Trusts represent a tactical financial tool for individuals seeking to handle and protect their possessions while possibly gaining from tax performances. Offshore Investment. Offshore counts on are established outside the individual's home nation, permitting for improved property defense, estate planning, and personal privacy benefits. They can secure possessions from creditors, legal insurance claims, and separation settlements, making them an attractive choice for well-off people or those in high-risk careers

Furthermore, overseas trust funds can give considerable tax benefits. Relying on the territory, they may use beneficial tax obligation treatment on revenue, check my reference funding gains, and inheritance. It is critical to navigate the lawful complexities and conformity demands associated with overseas counts on, as falling short to do so can result in serious fines. Consequently, seeking specialist advice is crucial for any individual considering this investment method.

Offshore Real Estate

An expanding variety of investors are turning to genuine estate in international markets as a way of diversifying their portfolios and taking advantage of global opportunities - Offshore Investment. Offshore realty investments offer a number of benefits, including prospective tax obligation advantages, property protection, and the possibility to obtain homes in emerging markets with high growth potential

Investing in offshore real estate permits people to take advantage of favorable additional info residential or commercial property legislations and policies in certain territories. Lots of countries provide rewards for international financiers, such as reduced taxation on capital gains or income created from rental properties. Having real estate in a foreign nation can offer as a hedge versus money variations, giving security in unpredictable financial environments.

Furthermore, offshore actual estate can create pathways for residency or citizenship in certain territories, improving monetary and individual flexibility. Investors typically look for properties in prime locations such as city facilities, playground, or regions undergoing significant growth, which can generate eye-catching rental returns and long-term recognition.

However, potential investors need to perform comprehensive due diligence, understanding local market problems, legal frameworks, and residential or commercial property management effects to optimize their offshore realty investments successfully.

Offshore Insurance Products

Checking out overseas insurance products has actually become a progressively preferred strategy for people and businesses looking for enhanced monetary security and asset protection. These items supply one-of-a-kind benefits, including tax obligation benefits, privacy, and adaptable financial investment choices tailored to personal or business requirements.

One more notable classification consists of wellness and traveling insurance coverage, which might use extensive coverage and defenses not offered in the policyholder's home country. These products can be especially helpful for expatriates or frequent vacationers who face special risks.

Inevitably, overseas insurance policy items present a compelling choice for those seeking to strengthen their economic approaches. By providing tailored remedies that stress privacy and tax performance, they can play a crucial function in a diversified investment portfolio.

Verdict

In verdict, offshore financial investments present diverse opportunities for wide range monitoring and property defense. Understanding the unique features of each offshore investment is important for entities and individuals looking for to navigate the complexities of international financing efficiently.

In a significantly globalized economic climate, recognizing the different types of overseas financial investments is critical for effective wealth management and property protection. Each investment car, from overseas financial institution accounts to mutual funds and depends on, offers distinctive attributes tailored to meet diverse economic goals.Additionally, offshore financial institution accounts can offer accessibility to a range of monetary solutions, consisting of financial investment chances, providing facilities, and wide range monitoring solutions.Capitalists in overseas common funds profit from the versatility to select different fund approaches, varying from traditional to hostile financial investment strategies. Recognizing the one-of-a-kind functions of each overseas financial investment is essential for entities and people looking for to browse the intricacies of worldwide money properly.

Report this page